The significance of personal finance apps has soared exponentially as individuals seek practical solutions that facilitate efficient money management and informed decision-making. By harnessing the power of these applications, users gain access to an extensive collection of sophisticated tools, consequently empowering them to accomplish desirable long-term financial objectives.

Some popular examples of personal finance apps today include Mint, Acorns, and PocketGuard.

Now, let’s discuss the essential steps to build your personal finance app with key features to include.

7 Steps to Build a Personal Financial App

To create a successful app, you must consider various aspects — from identifying your target audience to incorporating essential features. This guide will outline seven steps to help you build a functional personal finance application.

1. Find Your People

To commence the development of a personal finance application, it is crucial to identify the intended audience. Here are a few methods you can use to understand your target user base:

- Market Research. Conduct thorough market research to analyze the existing personal finance app landscape. Identify the gaps and opportunities that can be addressed with your product. You can consider factors like demographics, financial goals, and user behavior.

- Competitor Analysis. Study your competitors’ apps to understand their target audience. Better yet, you can identify areas where you can differentiate your app and offer unique value propositions to attract users.

For example, let’s say your app focuses on budgeting for young professionals. In that case, you can target individuals in their 20s and 30s who are starting their careers and have specific financial goals, such as saving for a down payment on a house or paying off student loans.

2. Define Your Vector

Setting clear project goals plays a crucial role in determining the success of your personal finance app. For that:

- define the problem or pain point that your app aims to solve. If you understand it clearly, you can ensure that your development efforts are focused and aligned with a specific need.

- Identify your app’s unique value proposition. Determine what sets your app apart from existing solutions in the market. Highlight the distinctive features or benefits that make your app stand out. For instance, it may offer AI-powered expense categorization or seamless integration with popular banking platforms.

- Think about the scalability of your app. Anticipate potential user base expansion and plan for scalability to accommodate increased usage and data storage. This ensures that your app can handle a growing audience without compromising performance.

By carefully defining your project goals, you set a clear direction for your personal finance app.

3. Design the User Interface (UI) and User Experience (UX)

The design should prioritize ease of use, logical navigation, and clear interfaces, allowing users to access and understand their financial information easily. Here are some considerations for designing an effective UI/UX:

- Streamline Registration and Onboarding. Make the registration and onboarding process seamless. You can do this by minimizing the steps required for users to create an account and set up their profile. Besides, provide clear instructions and guidance to help users get started quickly.

- Visual Hierarchy and Consistency. Visual hierarchy principles highlight important information and guide users’ attention. Use consistent design language throughout the app and maintain consistency in typography, colors, icons, and overall layout.

- Clear and Informative Dashboards. Design informative and visually appealing dashboards that give users a snapshot of their financial status. Display key metrics, such as account balances, budget progress, and investment performance concisely and easily. Utilize charts and graphs to visualize data and trends effectively.

- Accessibility. Incorporate features such as adjustable font sizes, high contrast options, and support for screen readers to make your app more inclusive.

- Usability Testing. Conduct thorough usability testing with a diverse group of users to gather feedback and identify areas for improvement. Iteratively refine your UI/UX design based on user feedback and observations to enhance usability and user satisfaction.

4. Create Basic Features and Test Them

Crafting the fundamental features that serve as the app’s building blocks is imperative to develop your personal finance app. Consider the following basic features:

- User Registration and Login. Include email verification and password recovery to enhance security and user experience.

- Data Entry and Management. Enable users to input their financial data, such as income, expenses, and transactions. You should also provide intuitive forms or interfaces for users to add, edit, and delete entries. Implement data management functionalities, like data synchronization across devices and data backup, to ensure data integrity and availability.

- Financial Tracking and Visualization. Develop features that allow users to track their financial activities, including expense tracking, budget management, and goal setting. Incorporate charts and graphs to help users visualize their financial data and monitor their progress toward their financial goals.

- Reminder and Notifications. Include reminder and notification functionalities to alert users about upcoming bills, payment due dates, or when they exceed budget limits. Personalize these reminders based on user preferences and provide options to set custom notifications.

- Security Measures. Implement robust security measures to protect users’ sensitive financial information.

- Iterative Improvements. Incorporate user suggestions, address usability issues, and make iterative improvements to enhance the overall user experience and app functionality.

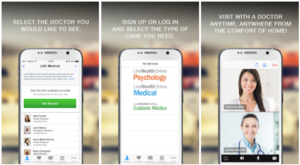

5. Launch the Application

The launch stage is exciting for any app developer. Before sharing your creation with the wider public, you will first go through careful preparation and thorough examination. This is where beta testing starts — enlisting a certain number of individuals as testers for your app. Their input proves invaluable in surveying potential flaws or areas where user experience could be enhanced further.

Identifying these aspects during beta testing enables you to address them promptly so that you launch a well-constructed final product worthy of public acclaim.

You can proceed with confidence to launch your MVP. It’s the bare-bones version of your app with the most essential features that you’ll launch to the public to start getting feedback and generating users.

6. Gather User Feedback

Collecting user feedback is a crucial stage in developing your personal finance app. The feedback you receive from your initial users provides valuable insights:

- Bug Identification and Resolution. Users often provide feedback about bugs or technical issues they encounter while using the app. This feedback helps you identify and prioritize bug fixes, ensuring a smoother and more reliable user experience. By promptly addressing these issues, you demonstrate responsiveness and improve user satisfaction.

- Validation of App Concept. User reviews can validate your app concept and its relevance in addressing users’ financial needs. Positive feedback and testimonials from users who find your app valuable can serve as social proof and attract more people. On the other hand, negative feedback can highlight areas that require improvement and guide your future development efforts.

- Enhance App Engagement and Retention. Gathering user feedback allows you to understand what drives user engagement and retention. By listening to your audience and incorporating its feedback, you can continuously improve and evolve your personal finance app to better meet its needs and expectations.

To collect user feedback effectively, consider implementing in-app feedback mechanisms — ratings, reviews, and feedback forms. Actively engage with users to encourage them to share their thoughts and suggestions. Regularly analyze and prioritize user feedback to guide your app’s future updates and improvements.

7. Maintain and Update the App

Maintaining and updating your app is crucial to ensure the product is stable and bug-free. After all, nobody wants to use an app that repeatedly crashes or encounters technical difficulties.

Ensure that your app remains in line with the latest trends and technologies. Users are constantly looking for the newest and most advanced solutions. Besides, regular updates can greatly enhance user experience by introducing new features or fixing bugs.

7 Essential Features to Add to the App

When designing a personal finance app, you must include crucial features that give users an extensive and secure experience when handling their finances. Integrating these features enhances the apps’ usability, and the utmost importance is given to maintaining privacy and security for users’ financial data.

1. User Registration and Authentication

User registration and authentication form the very bedrock of your application, for they empower users to establish accounts and securely log in. The login procedure must remain straightforward but secured enough to safeguard user data.

- Simplified Registration. Streamline the process by minimizing the required fields and steps. Ask for essential information such as name, email address, and password. Consider offering social media login options to give users a quicker registration alternative.

- Secure Password Management. Implement the best password management practices to ensure user account security. Encourage users to create strong passwords and consider incorporating password strength indicators.

- Two-Factor Authentication (2FA). To bolster security, it is recommended to incorporate two-factor authentication. This added security measure necessitates users to furnish a secondary verification method alongside their password.

- Biometric Authentication. The integration of biometric authentication methods, such as fingerprint or facial recognition, enhances your finance app. They contribute an extra layer of security when logging in.

- Account Recovery Options. Implement password recovery mechanisms like email verification, security questions, or one-time password (OTP) verification.

- Secure Data Transmission. Use secure communication protocols like HTTPS to encrypt data transmitted between the app and the server. This ensures that user credentials and sensitive financial information are protected from unauthorized access during transactions.

- Regular Security Audits. Conduct regular security audits to identify and address any vulnerabilities or potential risks in your app’s authentication system. Stay updated with the latest security practices and promptly apply necessary patches and updates.

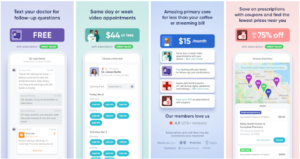

2. Dashboard

The dashboard is a critical feature of any financial app. It should be easy to use and customizable.

Here are some of the key functionalities that a financial app dashboard should include:

- Account balances. The dashboard should display the current balance of the user’s accounts. This includes checking, savings, investment, and credit card accounts.

- Income. The dashboard should display the user’s income for the current month or year. Users can track spending habits and identify areas where money could be saved.

- Expenses. The dashboard should display the user’s current month or year expenses.

- Investments. The dashboard should display the user’s investments. Users can track the performance of investments and make informed financial decisions.

- Trends. The dashboard should display trends in the user’s financial data. This information can be used to identify patterns in spending habits.

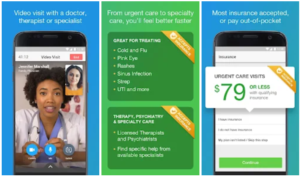

3. Budget Tracking

An indispensable feature of any financial application lies in its ability to effectively track one’s budgetary allocations. It should empower users to:

- Set budgets for different categories. Users must be able to set budgets for various categories, such as groceries, transportation, and entertainment.

- Track spending against budgets. Users should be able to track their spending compared to their set budgets.

- Check visual representations of spending. The budget tracking feature should provide visual representations of spending.

- Get alerts for budget compliance. Users should get alerts for budget compliance.

4. Expense Tracking

Expense tracking allows users to enter and classify their expenses for better financial management. Users can input details such as the date, amount, category, and expense description. This manual entry method ensures users can accurately record their transactions.

You can also integrate your app with users’ bank accounts or credit cards to simplify the expense-tracking process. It allows for the automatic import of transactions. Ensure the integration is secure and reliable, prioritizing the protection of users’ sensitive financial data.

Additionally, consider implementing an auto-categorization feature. The app can automatically assign categories to imported transactions based on patterns and keywords by leveraging intelligent algorithms. However, it is important to allow users to review and modify auto-categorized expenses as needed.

You can offer a receipt capture feature to enhance the expense tracking experience further. Users can take photos of paper receipts or upload e-receipts received via email, storing them within the app. This helps them record their expenses and provides additional documentation for future reference.

As users track their expenses, the app can generate visual representations and analysis of their spending patterns. Charts, graphs, and reports can illustrate monthly breakdowns, category-wise expenditures, and other insights. This analysis empowers users to identify high-spending areas and make informed financial decisions.

Users can easily locate specific transactions based on date, amount, category, or description by offering expense search and filtering functionalities. Implementing data synchronization across devices ensures users can access their expense records seamlessly, regardless of their device.

5. Bill Reminders

Incorporating bill reminders into your personal finance app is crucial to ensure timely bill payments and avoid penalties or fines. Here’s how you can effectively implement it:

- Enable users to enter details as it allows them to maintain a comprehensive record of their upcoming bills.

- Provide customizable reminder settings to set users’ preferred frequency and timing of reminders. Users should be able to receive reminders a few days before the due date or on the due date itself.

- Send timely notifications and alerts to users based on their reminder settings. Utilize push notifications or email reminders to inform users about upcoming bills. Include essential details in these notifications, such as the billing name, due date, and amount due.

- Offer the flexibility to set multiple reminders for bills with longer payment cycles. Users should be able to schedule reminders at appropriate intervals to ensure they do not miss any payments.

Integrate your app with payment gateways or provide direct payment options. This allows users to conveniently make bill payments directly from the app.

Consider incorporating smart features such as automatic bill payment scheduling. This feature can enable users to set up recurring payments for bills that have fixed amounts and due dates.

6. Goal Setting

Goal setting allows individuals to establish and track objectives related to their finances effortlessly. This way, they can monitor progress towards desired outcomes such as saving for vacations or purchasing property.

Customization serves as a foundational pillar within this feature’s effectiveness. Users should have complete control over which financial objectives they wish to prioritize for monitoring purposes, and how they prefer relevant information displayed. This aspect allows users the flexibility to tailor goal-setting capabilities according to individualized specifications.

7. Reports and Analytics

Incorporate a reporting system that generates detailed reports summarizing users’ financial data. These reports must cover various aspects, including income, expenses, savings, investments, and debt. The information should be presented clearly and concisely to enable users to interpret and analyze their financial situation easily.

Visual representations help users grasp information quickly and identify trends, patterns, and areas that require attention. For example, use pie charts to illustrate expense breakdown by category or line graphs to depict income trends over time.

Offer insights and analysis alongside the reports and visualizations to provide users with valuable information. For example, highlight areas where users have exceeded their budget or suggest optimizing spending. This accessibility lets them stay updated on their financial health anytime and anywhere.

RoveTek Can Help You to Build a Personal Finance App

Developing a comprehensive personal finance app with crucial features requires you to navigate the complexities of careful planning and precise execution. Luckily, you can partner with experienced professionals like RoveTek who can significantly streamline the development process.

RoveTek’s expertise in personal finance app development, our commitment to user-centric design, and our focus on security and privacy make us an ideal partner in creating a personal finance app. Collaborate with RoveTek to tap into our extensive expertise and wealth of experience in developing your personalized personal finance app.